Introduction:

Medicare business is simply the sale of Medicare insurance products from a licensed sales agent to an eligible beneficiary. Adaptability, resilience, and focus are three traits that many successful agents share. The creativity of the agent is what brings great opportunities in this market. In this essay, you will find blueprints for the creation of a Medicare agency, motivations to enter the industry, and painful mistakes to avoid.

Vision and Mission:

Business, like any action, begins with a desire. For an agent to build a well structured, profit-generating agency, they must first have a strong desire to do so. This desire will define the direction of your business, defining this desire as clearly and concisely as possible allows your employees and clients to understand your business methodology. We call this your “Founders Story.”

Defining your founders story will set the course for your business. There was a great thinker, Friedrich Nietzsche, who said, “He with a why can bear almost any how.” This, to me, captures the importance of your founder’s story. If you have a clearly defined vision for how you will exchange value with consumers, you are ready to begin designing the business.

Preliminary Needs:

The simplest questions are the most important to begin with; building upon a strong foundation is more predictable than one that is unfit. Finding a ground to build upon is essential, thus we begin by completing the regulatory requirements.

Selling a product requires a license to do so; agents must also be contracted and certified with each product. As part of your vision, you will identify where you will be transacting this business and how you will deliver information to clients. Contracting and certification are done either directly with the carriers or with an Independent Marketing Organization (IMO), like Simplicity Group.

A simple objective for an agency is to present interested prospects with quality products that provide relief from their unique problem or desire. In theory, all that is needed is to find a beneficiary, provide them with a solution, and submit an application. Easy to understand, difficult to accomplish.

Growing Your Business:

Your business will grow in the direction that your vision outlines, which reinforces the importance of defining that vision. If your vision is poorly defined, the vagueness could consume your energy by constantly requiring you to connect individual context with your abstract vision.

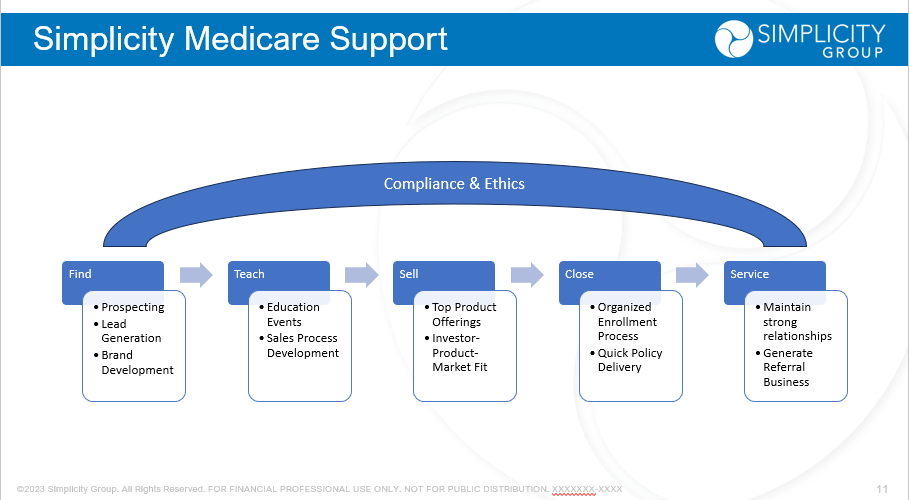

We recommend being patient and intentional in building a system that supports your unique skillset. A simple framework to build from is the Find, Teach, Sell, Close, Service structure shown in the image below.

These 5 pillars are the skills that will lead you toward a repetitive process, which we feel is essential for Medicare agents. Medicare is a business that does not generate significant commissions via lump sum, single insured policies. Medicare products come with smaller commissions, putting a premium on efficiency and volume. Independent agents are up against large corporations with internal sales teams, though we believe independent agents have significantly more value to clients than captive agents.

Compliance and Ethics are overarching themes that are to be applied to each of these “skills.” Your founder’s story will show through each of these pillars. The advantage you have is that nobody can compete with you at being you, so make your agency about YOUR process.

One hindrance to independent agents is that they don’t receive comradery or support like you would see at a carrier or large agency. We’ve found that agents who encounter opposing ideas more frequently grow more rapidly.

Potential Landmines:

Infinite obstacles lay on an unwalked path, but understanding the nature of obstacles and paths will allow you to potentially avoid obstacles commonly seen by others journeying a path. Attempting to walk the line between obscure examples and broad generalizations, here are a few suggestions that may save you energy in building your practice.

#1 Riding the Waves

Disruption is a word many Medicare agents, IMOs, Carriers, and regulators discuss frequently. This is natural with any complex system, as the massive number of variables at play in the Medicare market can sometimes configure the market landscape in curious ways.

We understand how difficult it can be to deal with uncertainty. When disruption happens, we encourage you to criticize the disruption in such a way that creates opportunities spawning from it. Ride the waves as they flow, and when you have the opportunity to improve your buoyancy, do so ambitiously.

#2 Copycat Industry

Sales jobs are creative by nature, the only limitations on your creativity are the ethical and compliance regulations defined by the participants of that market. Humans are creative, but we are also memetic creatures; we share and communicate by categorizing, generalizing, and stereotyping.

This is something to be aware of. If you are competing with an agent by copying his business model, you will lose since he has soul poured into his work. By understanding our tendency to copy others, we can discover better methods to achieve our desires by taking a wanted skill and filtering it through the lens of our business vision. Do not copy and paste. With creative pursuits, there is no possibility of replication.

#3 Honeymoon Phase

If you’ve been in love, you likely have experienced a honeymoon phase within that relationship. A time when the emotions of bliss and excitement overwhelm your spirit. This is something to be careful with in this industry.

The compensation structure of Medicare products is designed for a long time horizon. The compliance requirements are front loaded, and even though knowledge is acquired over time, you’ll never truly understand the next client’s situation until you meet them.

It is not uncommon to see agents eagerly pursue Medicare, enticed by the abundance of opportunities within the market, only to become overwhelmed by such abundance. A common cliche in this market is that “worthwhile things take time to acquire.” Patience and persistence through the initial excitement of a new venture is critical. Anticipating this honeymoon phase may help you design a vision or system that is more suited to your individual preferences.

Now, Where to Begin:

The best time to start your Medicare business is 20 years ago, that way you can pursue your sales tomorrow knowing that you have some cash flow already. The second best time to start is today, by doing self-research and discussing the potential opportunities Simplicity Group could help identify.

If you are in the financial services business, advise clients who are 65+ and are curious how advisors in similar positions to you are capitalizing with Medicare visit Simplicity Group.

Leave a comment